Car Trade Insurance Explained: The Three Pillars of Protection for Dealerships and Shops

Updated: November 3, 2025

Share:

If your business involves buying, selling, repairing, or storing vehicles that you do not personally own, you need a highly specialized policy often referred to as Car Trade Insurance or Motor Trade Insurance.

In the U.S. insurance market, this is called Garage Insurance, and it is the single most important policy for auto repair shops, body shops, service stations, and car dealerships. Why? Because a standard commercial liability policy explicitly excludes damage to vehicles that are in your “care, custody, or control”—which is your entire business model.

Here is a breakdown of the three essential pillars of Garage Insurance and the unique risks they cover.

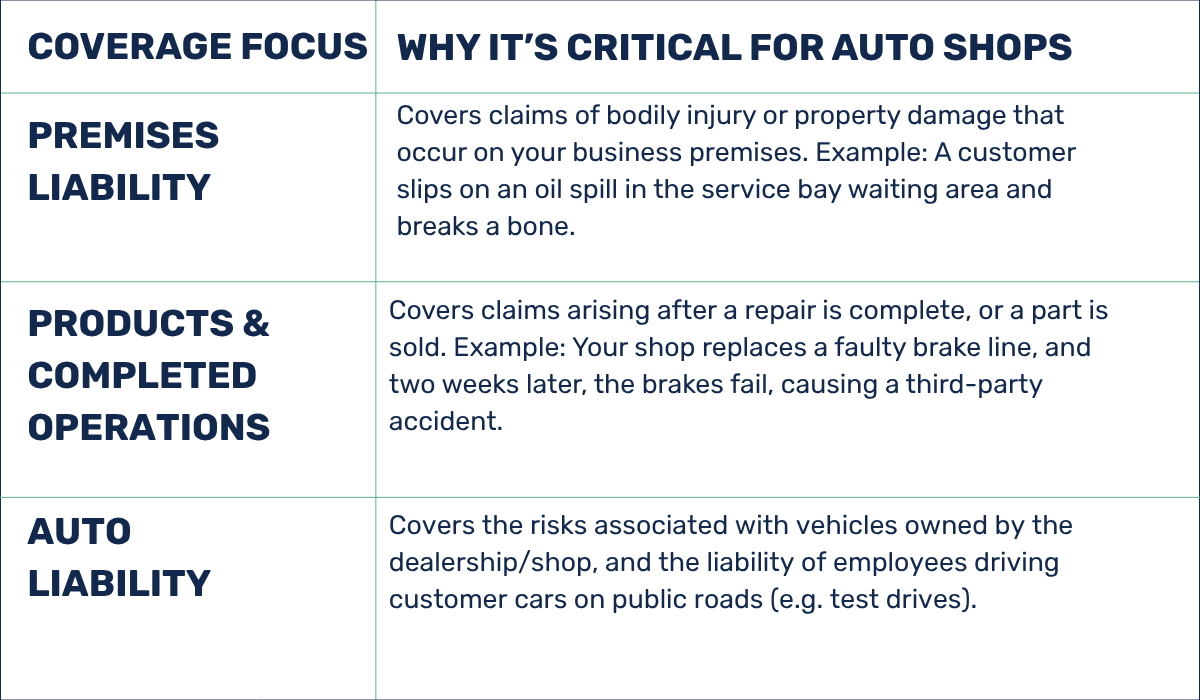

Pillar 1: Garage Liability Insurance (The Foundation)

Think of Garage Liability as your general defense shield. It replaces standard General Liability insurance, which would otherwise exclude auto-related business risks.

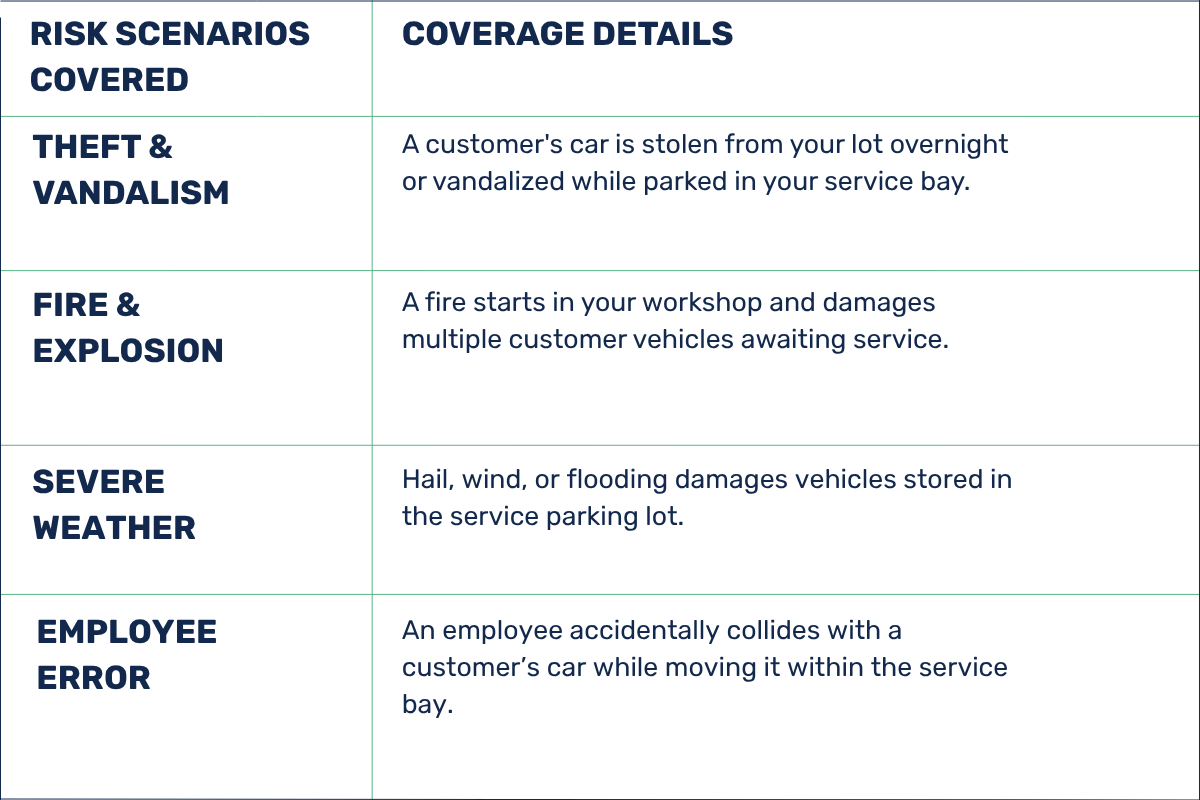

Pillar 2: Garagekeepers Insurance (Protecting Customer Assets)

This is the most specialized coverage in your policy. Garagekeepers Insurance protects your business from financial loss if a vehicle left in your care is damaged, stolen, or lost.

This coverage is vital because, once a customer drops off their car for service or storage, your legal liability for that vehicle skyrockets.

Important Note: Liability Options

When purchasing Garagekeepers coverage, you typically choose a legal liability option that affects when your insurance pays:

- Legal Liability: Pays only if your business is legally found at fault or negligent for the damage (e.g. you failed to lock the bay door leading to theft).

- Direct Primary: Pays for the damage regardless of who is at fault, offering the greatest peace of mind to your customers.

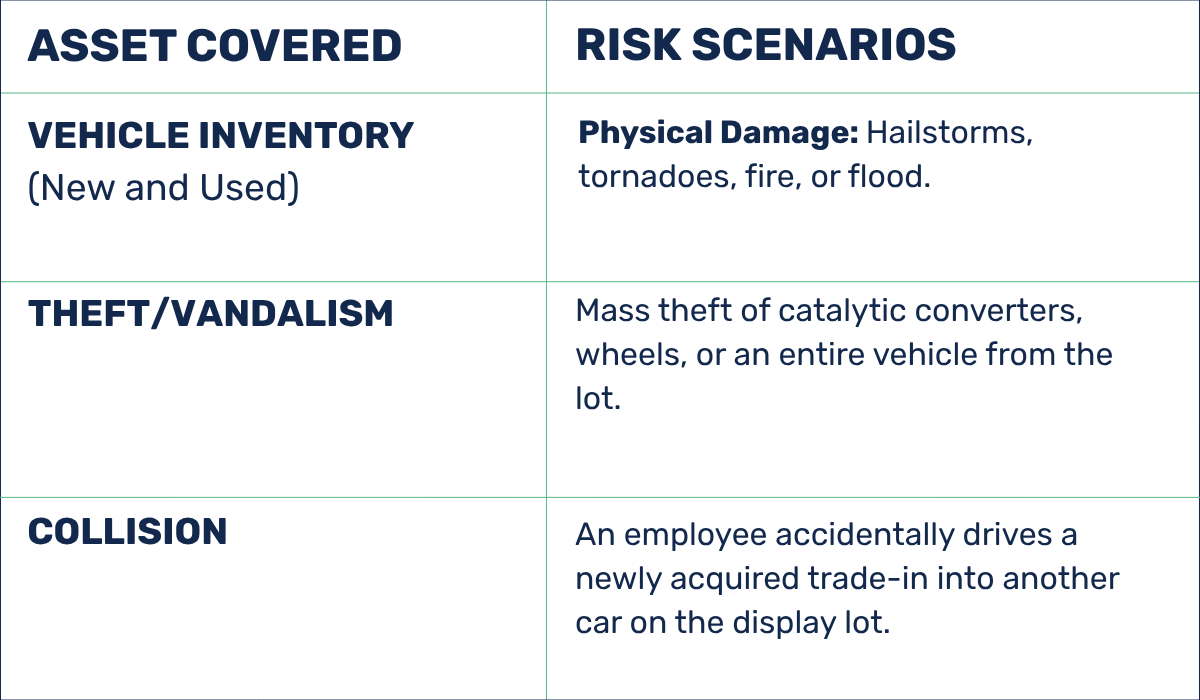

Pillar 3: Dealers Open Lot (DOL) Coverage (Protecting Inventory)

If you are an auto dealer selling vehicles (new or used), your inventory is your highest-value asset. DOL coverage is your exclusive property protection for that stock.

Essential Endorsements to Consider

Even with the three core pillars, auto-related businesses have high professional and crime exposures that require special add-ons:

- Mechanics Errors and Omissions (E&O): Protects you from claims arising from professional mistakes, such as errors on vehicle history reports, faulty financial documentation, or claims of incorrect repair advice.

- Employee Dishonesty: Covers your business against financial loss due to theft of cash, parts, or tools committed by an employee. This is separate from the Garagekeepers coverage for customer property.

- False Pretense Coverage: Essential for dealers. This covers losses if a vehicle is acquired by fraud (e.g. a customer uses a stolen identity or a bad check to acquire a car).

- Environmental/Pollution Liability: Given the presence of oil, grease, hydraulic fluids, and chemicals, this protects you from cleanup costs and lawsuits following an environmental spill on your property.

Car Trade Insurance is complex, but it is the only way to protect the high-value, non-owned property that drives your business. To ensure you have all three pillars of coverage and the necessary endorsements, contact Hitchings Insurance today for a specialized review of your operation.