Your Definitive Guide to Cleaning Business Insurance

Updated: November 3, 2025

Share:

You’re in the business of trust. Every day, your team enters client homes and commercial spaces, handling valuable property, using powerful chemicals, and navigating high-traffic environments. This unique trust comes with a heightened level of risk that a standard business insurance policy simply isn’t equipped to handle.

Whether you run a residential maid service, a commercial janitorial company, or a specialty carpet cleaning service, Cleaning Business Insurance is non-negotiable. It’s the financial safeguard that ensures a single spill, slip, or claim of theft doesn’t wipe out your hard-earned business.

Here is a breakdown of the unique risks your cleaning business faces and the essential coverages you need to secure your future.

The Unique Risks of the Cleaning Industry

Cleaning services face five distinct categories of risk that go far beyond a general storefront’s liability.

- Damage to Property in Your Care (The Exclusion Trap) – Most General Liability policies have a “Care, Custody, or Control” exclusion. If you break something you are actively cleaning or working on—a client’s antique vase, a laptop on a desk, or a specialty fixture—a standard policy might deny the claim.

- Risk Example: An employee accidentally drops a client’s expensive commercial floor polisher, or a vacuum cleaner cord damages a flat-screen TV.

- Faulty Workmanship & Chemical Misuse – Your business relies on precision and the use of powerful agents. An accidental mix-up can lead to permanent damage that far exceeds the cost of a routine claim.

- Risk Example: Using the wrong cleaning agent on an expensive marble floor or hardwood surface, resulting in permanent etching or discoloration.

- Risk Example: Improperly mixing chemicals, leading to noxious fumes that cause a client to become ill.

- Employee Dishonesty (The Need for Bonding) – Because your employees often work unsupervised in client offices and homes, a client may claim that an employee stole money or valuable property. This is a claim of employee theft, not general liability.

- Risk Example: A client alleges a piece of jewelry or cash went missing after your cleaning team was on-site.

- The Wet Floor Liability – Wet floors, trailing equipment cords, and obstacles are inherent to the job site. This dramatically increases your exposure to slips, trips, and falls.

- Risk Example: A client, employee, or visitor slips on a freshly mopped office hallway and suffers a severe injury like a concussion or broken limb.

- Equipment Mobility and Loss – Your essential gear—commercial vacuums, floor buffers, pressure washers, and specialized tools—are constantly in transit or stored temporarily at job sites, making them vulnerable to theft or damage away from your office.

- Risk Example: Your high-value carpet cleaner is stolen from your company van overnight, or a pressure washer is damaged during transit.

Essential Coverage Checklist

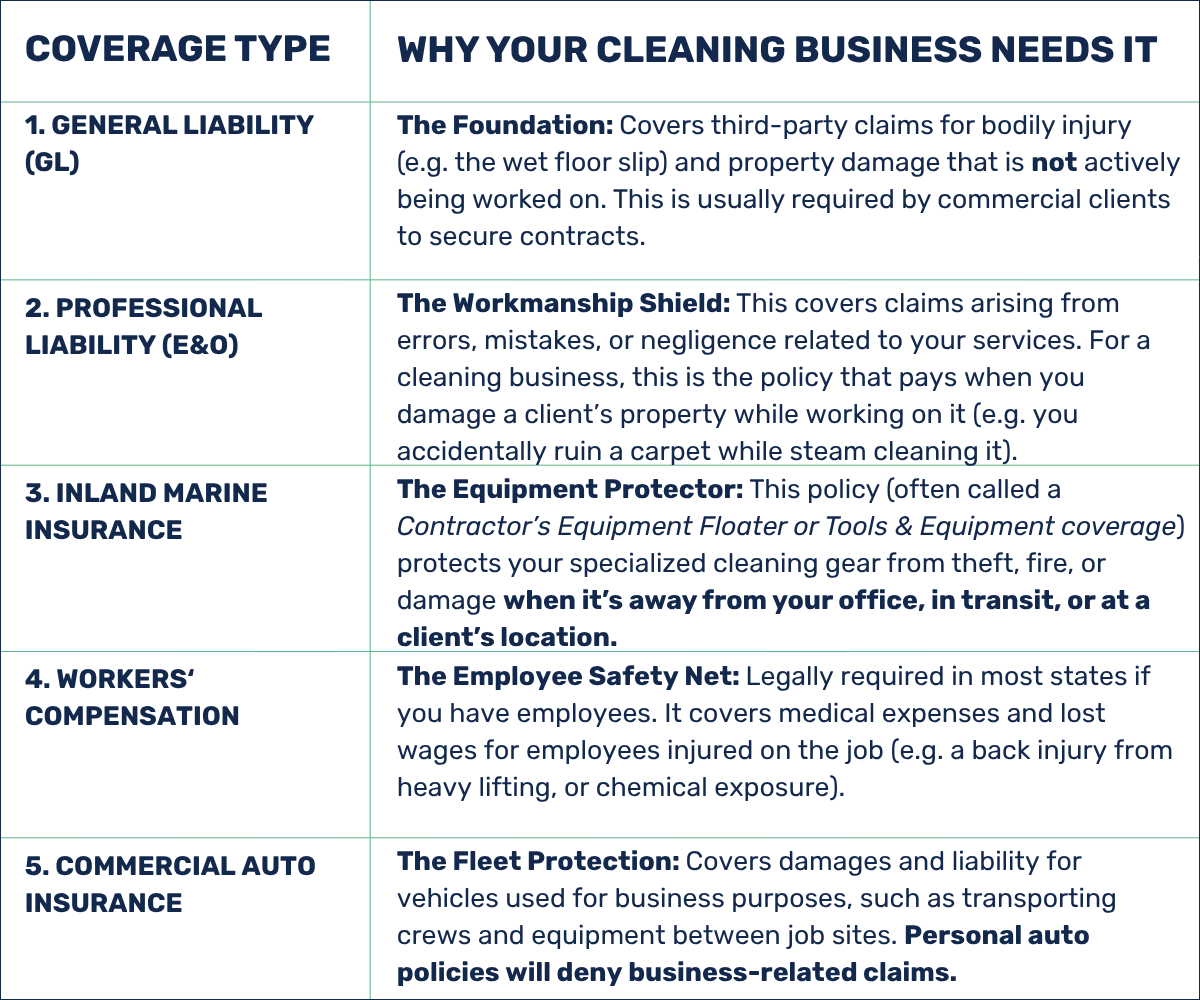

Your insurance plan must be a layered defense that addresses all five risk categories above.

Key Endorsements and Financial Safeguards

To address the highest-level risks unique to the cleaning industry, you should also consider these add-ons:

- Janitorial Bond (or Fidelity Bond): This is a separate policy that protects your clients against financial loss due to employee theft or dishonesty. While it’s not insurance, it is a crucial marketing tool that proves your company is trustworthy.

- Lost Key Coverage: If your employee loses a client’s key, this endorsement can cover the cost of replacing the locks or re-keying the building.

- Commercial Umbrella Policy: Provides an extra layer of liability protection above the limits of your General Liability and Commercial Auto policies. This is vital if you work in high-value commercial buildings or have large contracts.

- Waiver of Subrogation Endorsements: Often required by large commercial clients. This endorsement prevents your insurer from trying to recover claim costs from the client, simplifying large contracts and showing you are a serious professional partner.

Ready to secure your business? Don’t let a missing endorsement or a denied claim put your hard work at risk. We specialize in securing cleaning businesses across Ohio. Contact Hitchings Insurance today for a free consultation. We will help you build a customized policy that includes all the essential endorsements—from Inland Marine protection for your gear to the right liability limits for your commercial contracts—giving you the financial confidence to focus on growing your business.