Your Toolkit Needs Protection: The Essential Guide to Handyman Insurance

Updated: November 3, 2025

Share:

As a skilled handyman or handywoman, your office is your client’s home or business, and your work involves everything from painting and plumbing to small repairs and installations. This flexibility is what makes your business valuable, but it also exposes you to a unique and complex array of risks.

Relying solely on a basic General Liability policy can leave massive gaps in your protection, especially when dealing with client property, expensive tools, and claims of faulty work.

Here is your essential guide to Handyman Insurance—the specialized coverage that protects your business, your wallet, and your reputation.

The Handyman’s Three Major Liability Risks

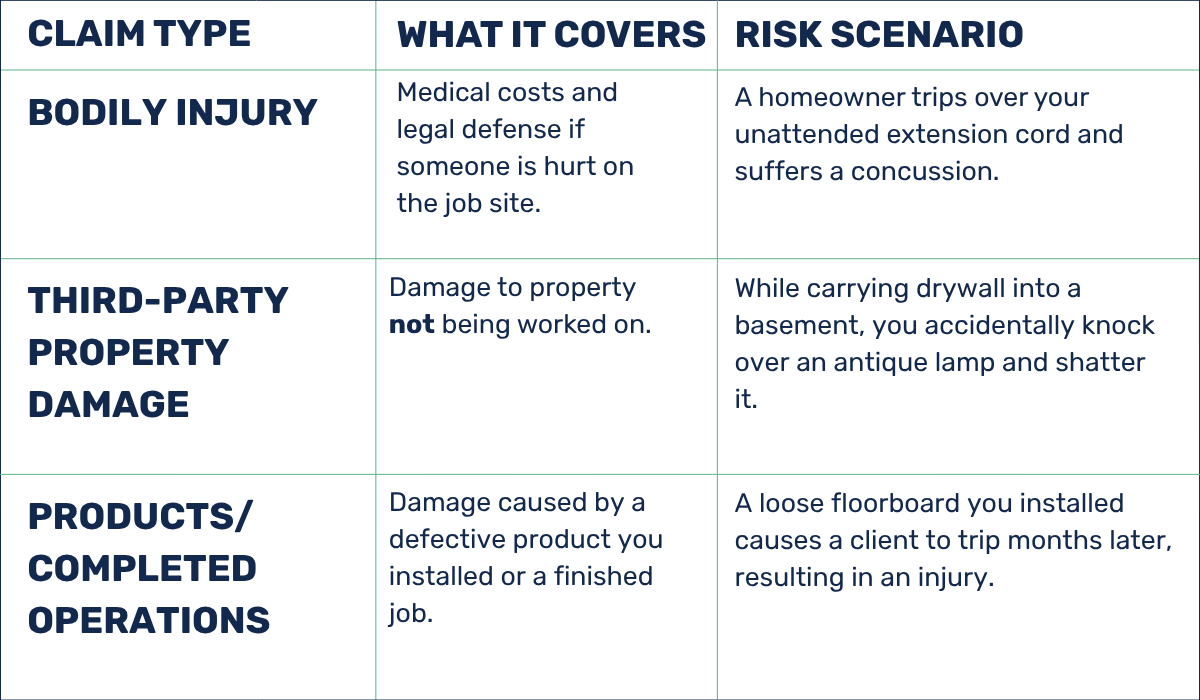

The biggest danger for any handyman comes from working directly on someone else’s property. Your insurance must address three distinct types of claims that can lead to catastrophic financial loss:

1. General Liability (The Accident Shield)

This is the most common form of insurance and the one most often required by clients. It covers bodily injury and property damage to a third party that results from your general operations.

2. Professional Liability (The Mistake Shield)

Often called Errors & Omissions (E&O) insurance, this policy is crucial because standard General Liability explicitly excludes claims of faulty workmanship.

- What it Covers: Legal defense and damages when a client sues you for an error, negligence, or an omission that resulted in a financial loss (not physical injury or property damage).

3. Risk Scenario: You incorrectly measure and install a bathroom vanity, requiring the plumber to rework all the pipes, costing the client an extra $1,500. Your E&O policy covers the resulting financial damages and legal fees.Tools and Equipment Insurance (Inland Marine)

Your business is only as good as its tools. Theft or damage to your gear while in transit or at a job site is a major business interruption risk.

- What it Covers: Repair or replacement costs for your owned tools, power equipment, and materials while they are away from your main business location, in transit, or left overnight at a job site.

- Risk Scenario: Your work van is broken into overnight while parked outside a client’s home, and $5,000 worth of power tools (saws, drills, etc.) are stolen. A typical Commercial Auto policy does not cover this loss—only Inland Marine coverage does.

The Essential Handyman Insurance Checklist

For comprehensive protection, your policy should be a packaged solution that includes the following:

Don’t Let a Single Mistake Shut Down Your Business

Handyman work is high-reward, but it is also high-risk. A single burst pipe during a plumbing repair or a costly professional mistake can result in a claim that forces an underinsured business to close its doors.

Take the time to secure the right insurance plan—one that moves with your tools, protects you from litigation, and guarantees that when a mistake happens, your savings account stays intact.

Contact Hitchings Insurance today to ensure your toolkit is protected and your business can handle any job with confidence.